Federal withholding calculator 2023

For employees withholding is the amount of federal income tax withheld from your paycheck. And is based on.

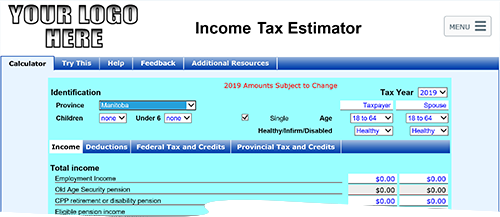

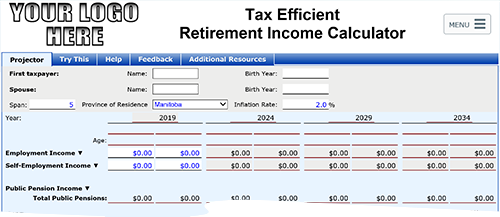

Knowledge Bureau World Class Financial Education

Although this publication is used to figure federal income tax withholding on periodic payments of pensions and annuities the methods of withholding described in this publication cant be.

. Contact a Taxpert before during or after you prepare and e-File your Returns. It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Based on your projected tax withholding for the year we can. This calculator is integrated with a W-4 Form Tax withholding feature. TurboTax offers a free suite of tax calculators and tools to help save you money all year long.

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. You can use the TurboTax W-4 withholding calculator to easily walk you through your. Start the TAXstimator Then select your IRS Tax Return Filing Status.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The amount of income tax your employer withholds from your regular pay. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

In case you got any Tax Questions. Calculate Your 2023 Tax Refund 2021 Tax Calculator Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results Estimate Your 2022. Complete a new Form W-4 Employees.

Use that information to update your income tax withholding. Then look at your last paychecks tax withholding amount eg. All taxpayers should review their federal withholding each year to make sure theyre not having too little or too much tax withheld.

250 and subtract the refund adjust amount from that. The IRS hosts a withholding calculator online tool which can be found on their website. Change Your Withholding To change your tax withholding use the results from the Withholding Estimator to determine if you should.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication. Tax Withholding Calculatorfigure out the taxes withheld from your salary to see if youre going to receive a tax refund or owe the IRS. This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee. This is the total amount withheld from your paychecks and applied directly to your federal tax bill over the course of a year based on your W-4 allowances. It will be updated with 2023 tax year data.

That result is the tax withholding amount. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 2022 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes.

2022 2023 Tax Brackets Rates For Each Income Level Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and. Form W-4 is completed by employees and given. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

250 minus 200 50. Use this simplified payroll deductions calculator to help you determine your net paycheck. Credits deductions Deductions are.

It is mainly intended for residents of the US. Doing this now can help protect against.

Tax Implications Of A Real Estate Assignment A Tax Exposure Calculator

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

H R Block Tax Calculator Services

Manitoba Income Tax Calculator Wowa Ca

Simple Tax Calculator For 2022 Cloudtax

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

2021 2022 Income Tax Calculator Canada Wowa Ca

Investing Invest Early Invest Often Finance Tips Wealth In 2022 Investing Finance Finance Tips

Knowledge Bureau World Class Financial Education

Knowledge Bureau World Class Financial Education

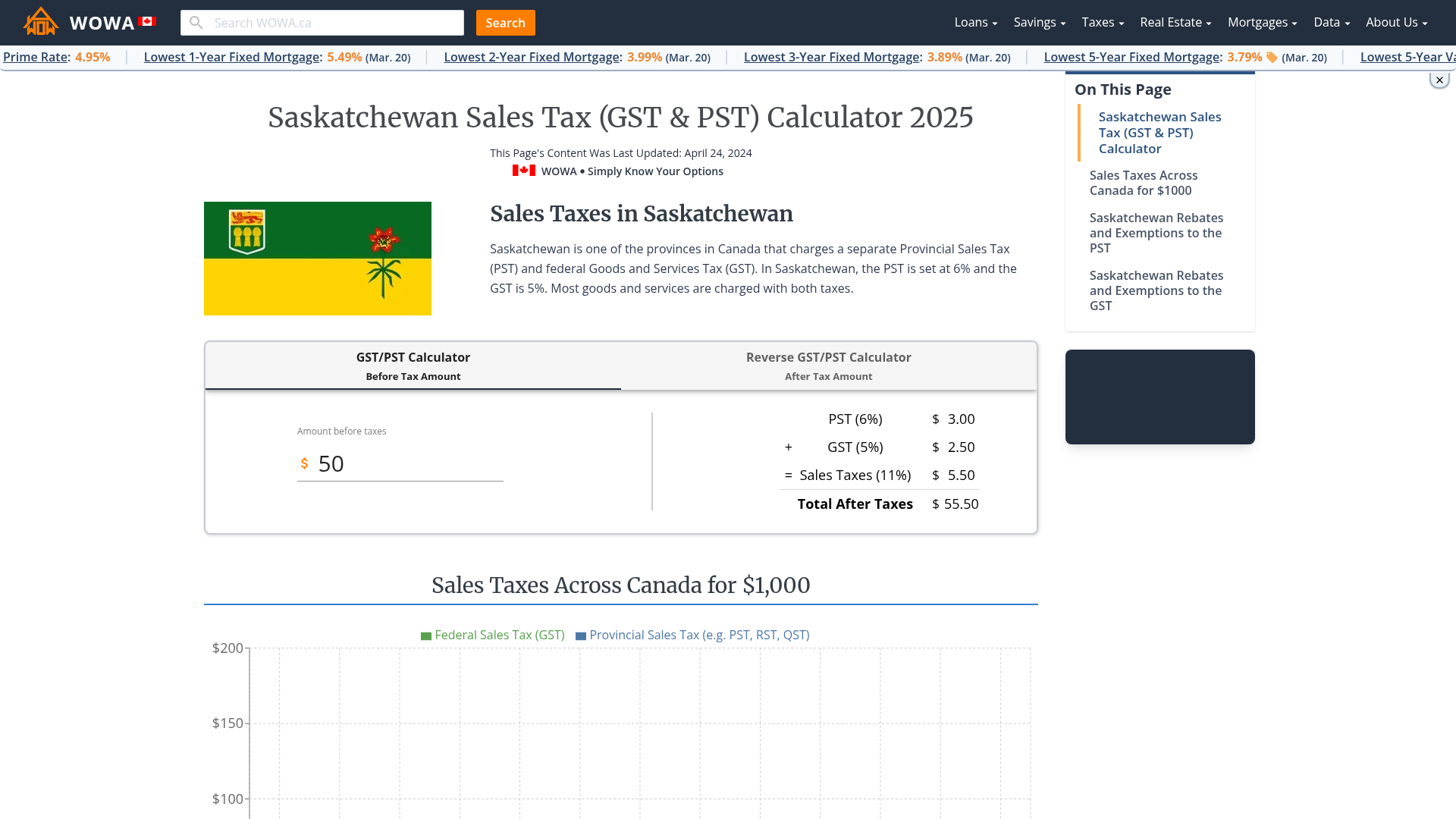

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Pin On Budget Templates Savings Trackers

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator